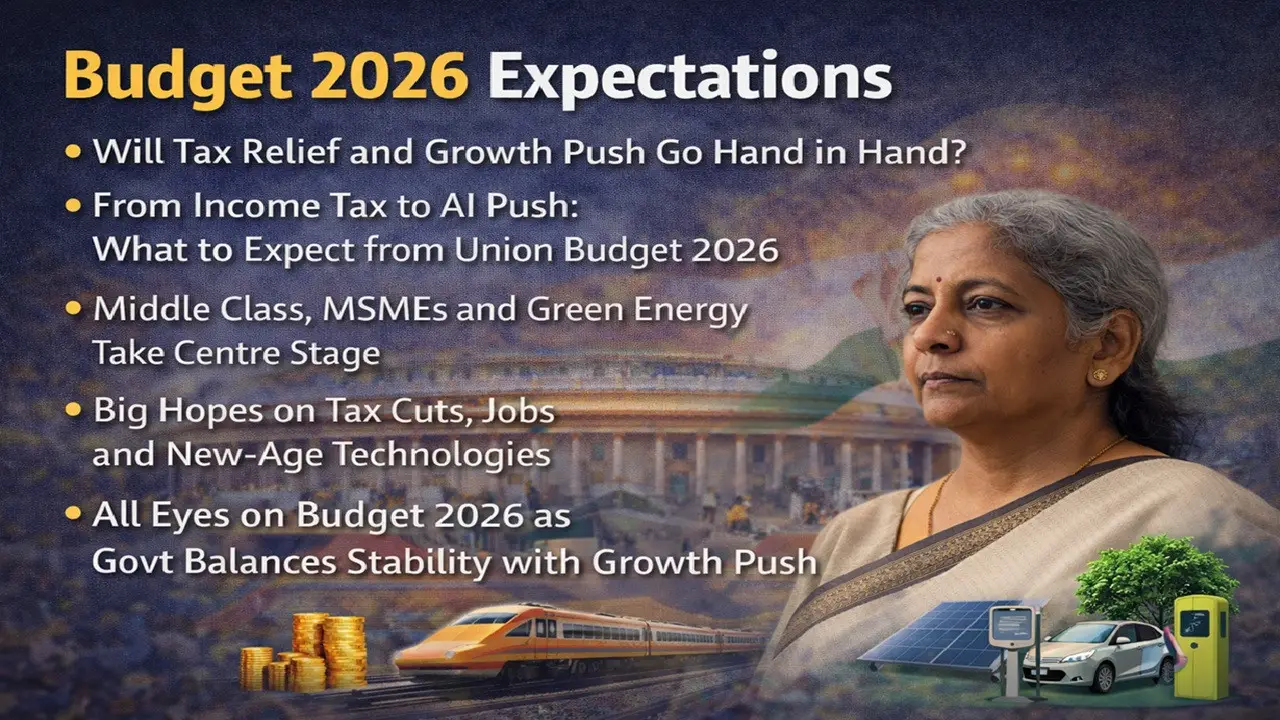

From Income Tax to AI Push: What to Expect from Union Budget 2026 (Open Ai)

New Delhi: Discussions regarding Union Budget 2026 have intensified. The Finance Minister will present the budget in Parliament on Sunday, February 1, 2026, at 11 am. This time the biggest expectation from the budget is to maintain economic stability, promote consumption, and simplify rules. The government's focus is likely to be on emerging sectors like manufacturing, agriculture, green energy, MSME, artificial intelligence, and robotics.

The salaried class has special expectations from this budget. According to experts, the standard deduction can be increased from Rs 75 thousand to Rs 1 lakh. This will increase the residual income. Consideration may also be given to increasing the limit of exemption on home loan interest.

The hopes of major changes in the new tax regime are considered weak at the moment. The reason for this is that in the last two budgets, the government has already given relief in tax slabs and rebates. The old tax regime is also likely to continue for the next few years.

For senior citizens, the limit of exemption on interest income under Section 80TTB can be increased from Rs 50 thousand to Rs 1 lakh. The logic behind this is that this limit has not been changed for a long time, and inflation is continuously increasing.

There may be a consideration of limiting TDS rates to 2-3 categories. Apart from this, it is expected that some provisions related to income tax will be further decriminalized so that the fear of compliance is reduced and disputes are reduced.

There is discussion about bringing uniformity in tax on different gold investment options. There may be clear rules for employees working abroad regarding ESOP taxation. Also, there may be an option to adjust the foreign tax credit at the TDS level itself.

After GST 2.0, there may be an emphasis on further simplifying input tax credit. Steps are expected to be taken towards digital litigation, faster dispute resolution and simplification of tariff structure in customs matters.

Budget allocation for the agriculture sector may be increased to Rs 1.5 lakh crore. Emphasis is likely to be on warehousing, insurance, and irrigation. At the same time, relief in stamp duty in real estate and increasing the limit of affordable housing can be considered.

Incentives and infrastructure support for AI, robotics, and deep-tech manufacturing may increase. Cheap and fast loans to MSMEs, while investments in green energy like solar, EV and green hydrogen are expected to increase.

Capital expenditure may increase to boost domestic production in defense. Steps like increasing the railway budget by about 10 percent and reducing customs duty on medicines and medical equipment in the health sector are possible.

Overall, Budget 2026 is expected to see the government striking a balance between growth and stability, with a focus on the middle class, industry, and future technologies.

Copyright © 2026 Top Indian News