Budget 2026: New Income Tax Act Will Come Into Affect From April 1; tax relief for accident victims (X)

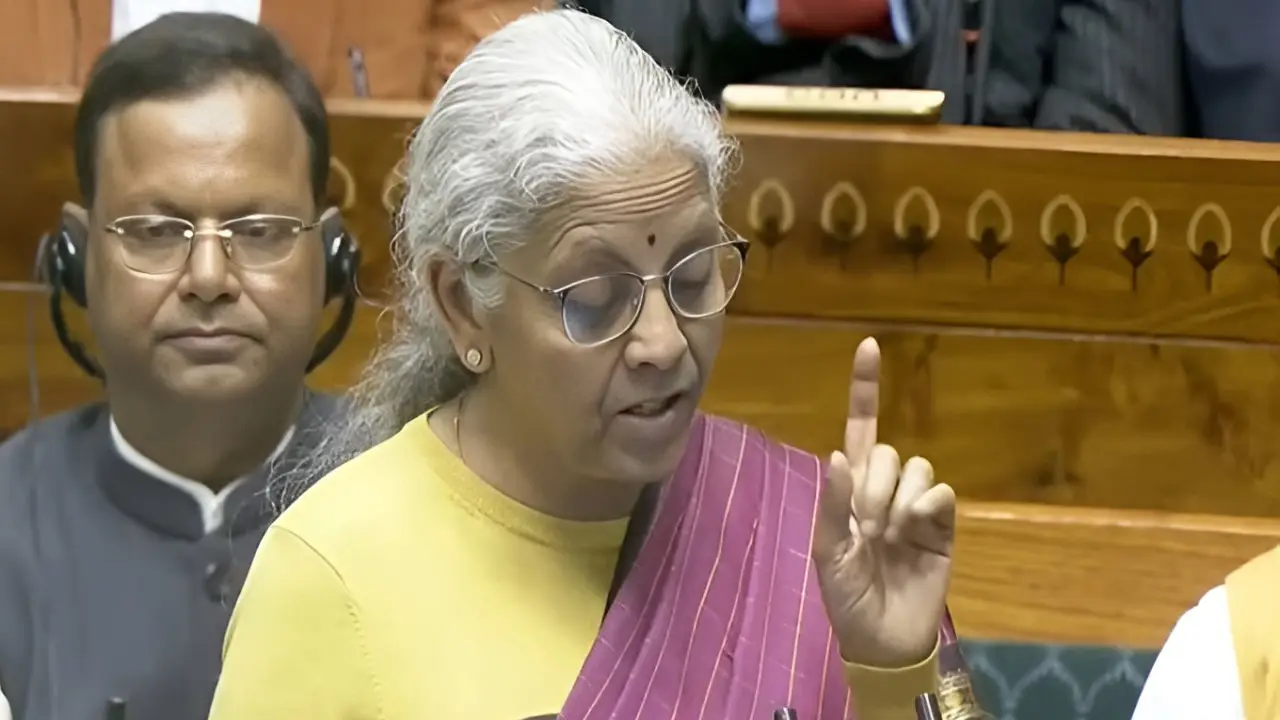

New Delhi: Union Finance Minister Nirmala Sitharaman while presenting her ninth consecutive Budget in the parliament on Sunday announced that the new Income Tax Act will come into effect from April 1, 2026.

The new Income Tax act, which will replace the six-decade-old tax law, was announced by the Union Finance Minister and said that simplified income tax rules and forms will be notified shortly.

During her Budget speech, Nirmala Sitharaman said that, "This (direct tax code) was completed in record time and the Income Tax Act 2025 will come into effect from first April 2026. The simplified income tax rules and forms will be notified shortly, giving adequate time to taxpayers to acquaint themselves with its requirements."

The Finance Minister during her speech also proposed to reduce the TCS (Tax Collected at Source) rate from current 5 per cent to 2 per cent for education and medical education under the Liberalised Remittance Scheme (LRS).

Nirmala Sitharaman also proposed to reduce the TCS rate on the sale of overseas tour packages. The rate will be cut from the current 5 per cent and 20 per cent to 2 per cent.

"I propose to reduce TCS rate on the sale of overseas tour program package from the current 5 per cent and 20 per cent to 2 per cent without any stipulation of amount," she said.

During the budget speech, Nirmala Sitharaman also proposed that interest awarded by the Motor Accident Claims Tribunal to a natural person will be exempted from income tax, and any TDS on this will also be done away with.

FM Sitharaman said, "I propose that any interest awarded by the motor accident claims tribunal to a natural person will be exempt from income tax and any TDS on this account will be done away with."

The Finance Minister also said that the deadline for filing of income tax (I-T) return has been revised from December 31 to March 31, on payment of nominal fee.

"We propose a rule-based automated process for small taxpayers in FY27 Budget. People filing ITR-1 and ITR-2 can continue to file till July 31. Non-audit business cases and trusts will be allowed to file returns till August 31," she said.

She also said that "now as a person you can file revised ITR by March 31 with a nominal fee".

Copyright © 2026 Top Indian News