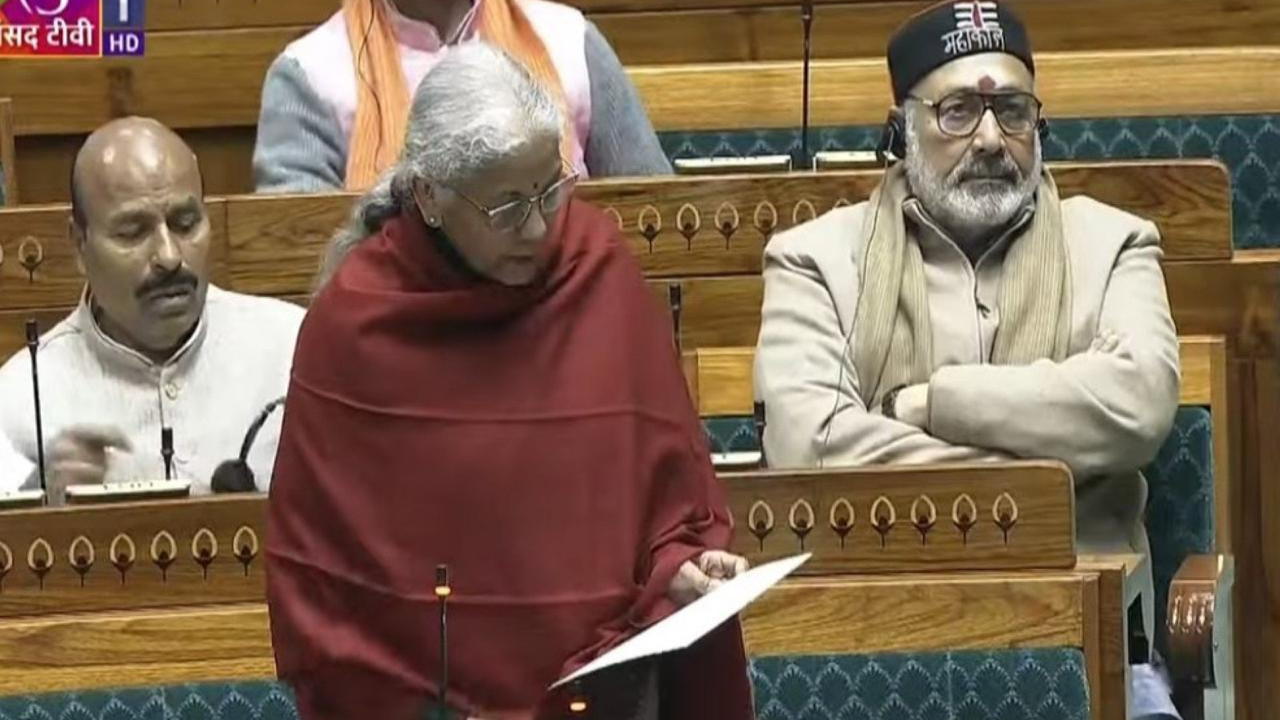

There are big benefits for taxpayers Budget 2026. (Image X @nabilajamal_)

New Delhi: Ahead of the Union Budget 2026-27, the Modi government presented the Economic Survey 2025-26 in Parliament on Thursday. The survey clearly shows that the government is gradually moving towards making the country's tax system simpler, more transparent, and based on trust. Whether it's significant income tax relief for the middle class or changes to the GST system, the survey indicates that paying taxes will not only become easier in the future but will also reduce the burden on people's pockets.

Regarding direct taxes, the biggest announcement is zero tax on income up to ₹12 lakh. According to the Economic Survey, those with an annual income of up to ₹12 lakh will no longer have to pay any income tax. Salaried individuals will also receive a standard deduction of ₹75,000, increasing the tax-free income limit to ₹12.75 lakh. The survey states that this has provided significant relief to the middle class, leaving them with more disposable income. Furthermore, the new Income Tax Act will come into effect from April 1, 2026, making tax rules even simpler and easier to understand.

The Economic Survey also shows that the number of taxpayers in the country has increased rapidly. The number of income tax return filers increased from 6.9 crore in FY22 to 9.2 crore in FY25. The government says this is not due to stricter enforcement, but rather due to a better digital system and the formalization of the economy. Significantly, the tax department is now adopting a "Nudge" model, which allows people to correct mistakes through data without resorting to intimidation. This has led to the disclosure of foreign assets worth over ₹29,000 crore.

Major changes in indirect taxes, i.e., GST, have also been hinted at. The government is moving towards a two-slab system (5% and 18%) under GST 2.0. GST has been reduced to 5% on everyday items such as soap, shampoo, and bicycles, while essentials like milk, bread, and cheese remain exempt from tax. The biggest relief comes from the proposal to eliminate GST on life and health insurance policies, which will make insurance more affordable. Overall, the Economic Survey 2025-26 indicates that the government aims to move forward with the tax system not through strict enforcement, but through simplicity, technology, and trust.Skechers Womens Summits

Copyright © 2026 Top Indian News