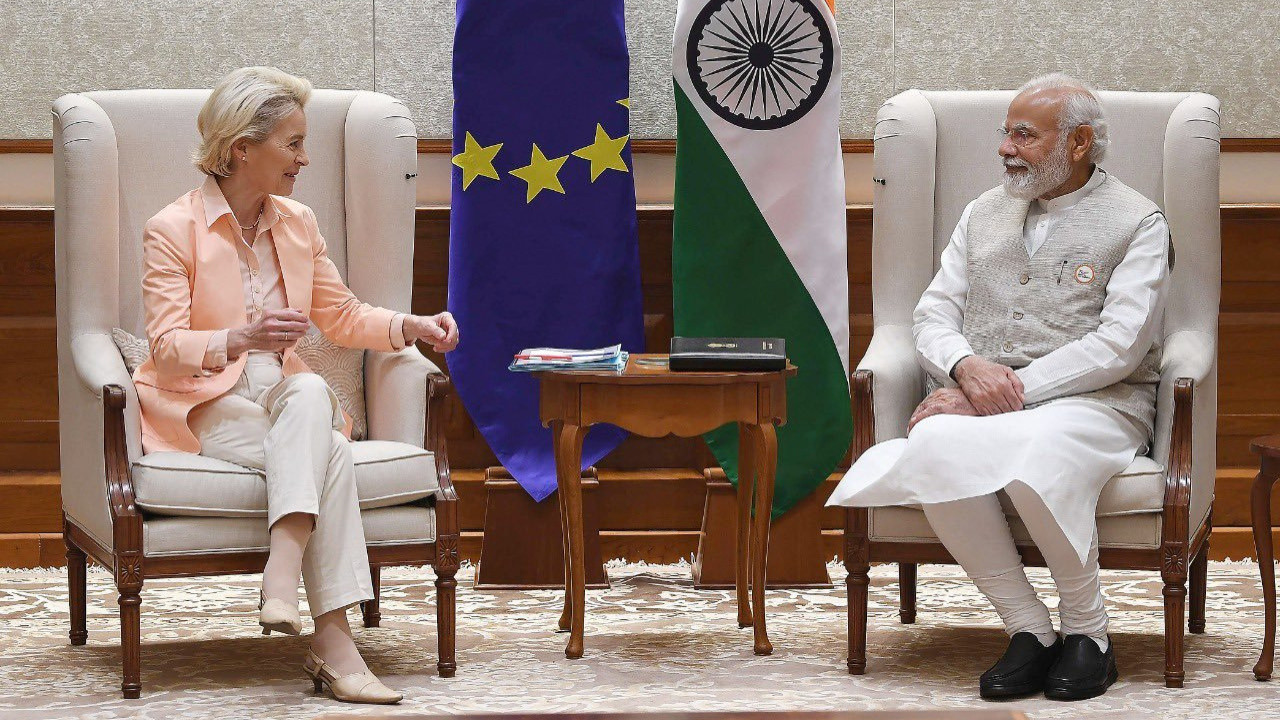

The long-stalled free trade agreement between India and the European Union appears to be gaining momentum. (Image X @ANI)

New Delhi: The long-stalled free trade agreement between India and the European Union appears to be gaining momentum. As part of this, the Indian government is preparing to significantly reduce import duties on cars coming from the European Union. The proposal is to reduce the current import duty, which can reach up to 110 percent, to 40 percent. This is being called the 'mother of all deals' and could give a new direction to trade relations between India and Brussels. Moreover, if everything goes well, this deal will lead to a significant reduction in the price of cars imported from Europe.

According to a Reuters report, the Indian government has agreed to immediately reduce import duties on a limited number of European-made cars priced above 15,000 euros (approximately 16.3 lakh rupees). There are plans to further reduce this tax to 10 percent in the future. This will make it easier for European brands like Volkswagen, Mercedes-Benz, and BMW to enter the Indian market.

Media reports, citing sources, suggest that this agreement could be announced by Tuesday. However, the Indian Ministry of Commerce and the European Commission have not yet made any official comment on the matter. Despite this, it is believed that both sides have reached the final stages of negotiations and a major announcement could be made at any time.

India and the European Union may soon announce the completion of negotiations on the free trade agreement. This announcement will mark the end of years of lengthy negotiations and discussions. However, the process of finalizing the agreement and obtaining approval from both sides will still remain, which will take some more time.

The biggest impact of this proposal will clearly be seen on car prices. Currently, cars priced at 45,000 to 50,000 euros in Europe often end up costing the same as or even more than their original price by the time they reach India due to the high taxes. This is why such cars become extremely expensive by the time they reach Indian showrooms.

If the import duty is limited to 40 percent, the tax burden will be significantly reduced. Even after adding GST and dealer margins, there will be a big difference in ex-showroom prices. According to experts, after the implementation of the new tax system, the ex-showroom prices of European cars could decrease by 30 to 50 percent. This means that cars costing crores of rupees could see a price reduction of approximately 25 to 30 lakh rupees.

This means that cars that are currently only accessible to a select few could find many more buyers. This decision could completely change the landscape of the Indian luxury car market. Currently, India's luxury car market is only 1 percent, and many leading car companies are struggling due to high import duties.

After the US and China, India is the world's third-largest car market. It is also considered one of the safest markets in the world. Cars imported into India through the Completely Built Unit (CBU) route attract import duties ranging from 70 to 110 percent. Foreign car companies have long been criticizing this policy due to the heavy import duties. They demanded that this import duty be reduced so that imported cars could be offered to Indian customers at reasonable and affordable prices.

Under the proposal, India will reduce the import duty to 40 percent on approximately 200,000 internal combustion engine (ICE), i.e., petrol and diesel cars, every year. However, the possibility of changes to this quota at the last minute has not been ruled out. This means that this figure could increase or decrease at the last moment. But this figure is quite high for luxury segment cars.

Battery-powered electric vehicles will be excluded from this exemption for the first 5 years. The government wants to protect domestic EV companies and their large investments. Recently, Tata Motors, Mahindra, and Maruti Suzuki have entered the electric vehicle segment. Therefore, this decision will prove beneficial for Indian companies. Similar duty cuts are expected to be applied to electric cars after five years. This means that major electric car manufacturers like Tesla, BYD, and VinFast will not receive any significant benefit for now. However, they do expect to benefit in the future.

The biggest beneficiaries of the reduced import tax will be companies like Volkswagen, Renault, Stellantis, Mercedes-Benz, and BMW. Many of these brands already assemble vehicles in India, but due to high import duties, they haven't been able to expand their businesses significantly. The reduction in duties will allow these companies to keep the prices of their imported cars as low as possible. It will also enable them to test new models in India, after which decisions regarding local manufacturing and investment can be made. Overall, this change could mark the beginning of a new era in the Indian automotive market.

Copyright © 2026 Top Indian News